Ypsomed: The Picks-and-Shovels Trade for the Weight-Loss Revolution

Everyone is focused on Novo Nordisk and the weight-loss drug revolution. The market for these treatments is entering a multi-year growth spurt — but is investing in Novo Nordisk or Eli Lilly really the only way to benefit?

Have you ever wondered how all these injectable drugs are actually administered?

Enter Ypsomed — the Swiss company that is a leader in the global market for the devices used to deliver such medications.

Ypsomed is the one-stop shop for pharmaceutical companies developing drugs that must be injected rather than swallowed. While companies like Novo Nordisk still manufacture many of their delivery systems in-house, the trend is clearly toward outsourcing — and Ypsomed is the main beneficiary.

That shift stems from the increasing complexity of injection devices and the rapid rise of biologic drugs. For every new drug that comes to market, a regulator-approved delivery mechanism is required.

In this article, I’ll explain why Ypsomed is such an attractive business — and potentially a long-term compounder hiding in plain sight.

What Ypsomed Does

Ypsomed designs and manufactures injectors for the delivery of biologic medicines.

Their product line is fairly simple: autoinjectors and injection pens.

An autoinjector is a single-use device that hides the needle and administers a fixed dose at the push of a button — conceptually similar to the injection pens used for GLP-1 drugs like Ozempic or Wegovy.

An injection pen, on the other hand, is reusable. It uses replaceable cartridges and allows for flexible dosing, making it suitable for treatments that require regular injections.

Today, the global injector market is effectively a duopoly-like market. Most industry watchers still list SHL Medical and Ypsomed as the two leaders; who’s “leading” depends on the segment/metric.

In 2024, Ypsomed made a strategic decision to focus entirely on its Delivery Systems division, selling its Diabetes Care unit to Tecmed. The Delivery Systems segment currently generates about CHF 500 million in annual revenue and has grown at roughly 24% CAGR over the past five years.

The Growth Engine: The Biologics Revolution

Consensus expectations call for strong growth ahead, primarily driven by the global expansion of biologic medicines.

Biologic drugs are made from living cells or organisms, rather than being chemically synthesized like traditional medicines. They consist of large, complex proteins that closely resemble those found naturally in the human body. These molecules can target specific receptors or proteins involved in a disease process — allowing for more precise and effective treatments.

Because biologics can act with far greater precision, their share of the global drug market has risen sharply. In 2005, less than 20% of newly approved drugs were biologics; in 2022 that figure was 40% and today it’s more like 50%.

The popular GLP-1 treatments — Ozempic and Mounjaro — are also biologics. They mimic the GLP-1 hormone, which is naturally produced in the gut and helps regulate appetite and digestion.

As healthcare systems push for more at-home treatments, Ypsomed’s devices are becoming increasingly needed.

The Threat of Oral Alternatives

In September 2025, Novo Nordisk announced that its new oral GLP-1 pill produced “significant weight loss”. Since that announcement, Ypsomed’s share price has slipped about 25%.

Eli Lilly , Novo Nordisks main competitor, had already published results for its own oral candidate, Orforglipron, which showed lower efficacy than the injectable Zepbound. Novo’s oral version (announced in september) performed slightly better than Orforglipron — but still worse than injections.

Patients have grown comfortable with weekly injectors: the needle is hidden, the process is simple, and the results are stronger. If injections deliver better outcomes, why switch to a pill that must be taken daily?

There will certainly be a market for pills, but neither Novo Nordisk nor Lilly wants to cannibalize its lucrative injectable business. Type-2 diabetes has long shown that oral and injectable treatments can coexist — and the same pattern will likely emerge in obesity care.

Even Martin Lange, Novo Nordisk’s Chief Scientific Officer, agrees: “The injectable will continue to be the biggest seller, but the oral will be a substantial segment.”

Injectables will remain the stronger option for patients who need maximum weight reduction or tighter glucose control. Pills will cater to lighter cases or those unwilling to inject.

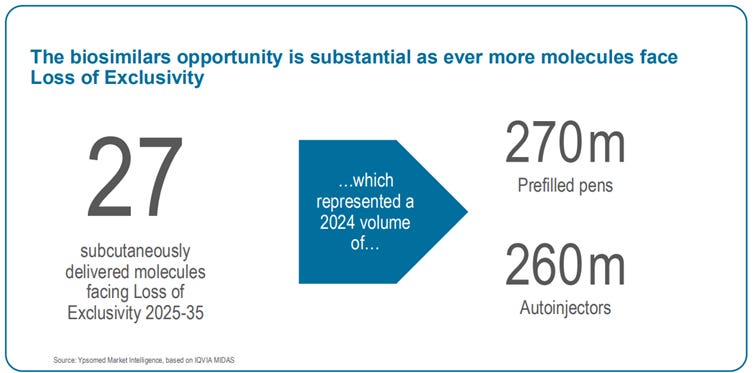

Even if that shift takes a small slice of growth; between 2025 and 2030, 27 blockbuster biologic drugs will lose patent protection. And biosimilar manufacturers, who compete mainly on cost, lack in-house device manufacturing capabilities — and will depend on companies like Ypsomed for injectors.

27 biologic molecules (drugs) are facing loss of patent. Source: Ypsomed capital markets day presentation.

And these biosimilars can’t be made into pills. By regulation, a biosimilar must be structurally and functionally equivalent to the original drug. If the originator is a protein delivered via injection, the biosimilar must follow the same route.

So yes — part of the GLP-1 market may shift toward pills. But injectables and orals will coexist, each serving its own segment. And Ypsomed still has a vast growth runway supplying the delivery systems behind the next generation of biologics.

Economics & Moat

At first glance, an autoinjector seems simple — just a spring-loaded needle that pushes medication under the skin. In reality, it’s a high-precision mechanical system where even small deviations in spring force, needle motion, or injection speed can cause the dose to fail.

That’s why injector design is tightly regulated. A new manufacturer would face 5–8 years of development and approval work and tens of millions in costs before bringing a product to market.

Ypsomed, by contrast, has decades of experience and operates a platform model:

the base injector design is already pre-approved, and only small adaptations are needed for each new drug. This dramatically shortens time-to-market for pharma companies who are developing a new drug.

Importantly, when the FDA or EMA approves a drug, it approves it together with its injector. That means pharma companies can’t simply swap delivery systems without restarting the entire approval process — creating strong lock-in for Ypsomed.

During the development phase, pharma clients pay Ypsomed “project revenue” for engineering work. Once the drug is commercialized, Ypsomed earns per-unit fees — that’s when the real profits start rolling in. Ypsomed refers to that revenue as commercial sales revenue.

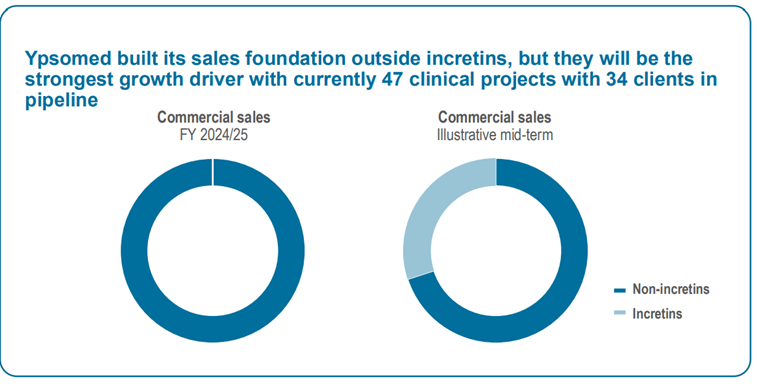

At the moment, Ypsomed has zero commercial sales revenue from the incretin market (glp1 medicines). Even taking into account all the new growth in GLP 1, the company projects incretin to be approximately 30% of commercial sales in the midterm. This is an important point, because the market still thinks Ypsomed is really dependant on Novo Nordisk.

Growth Outlook

In the year ending March 2025, Delivery Systems revenue rose 30.4%, accelerating from a five-year CAGR of 24%. Management guides for CHF 1 billion revenue by 2029/30, implying about 15% annual growth. They target EBIT margins of 30% — roughly in line with today’s levels.

Personally, I think that forecast is conservative. With the strong biologics pipeline and the upcoming wave of biosimilars, it doesn’t make sense for the growth rate to slow relative to the past five years.

Valuation

Earnings per share will jump sharply in FY 2025–26, boosted by the sale of the loss-making Diabetes Care unit to Tecmed.

Per Koyfin data , the next twelve months (NTM) pe ratio is 23.9. In the last 5 years, the stock has traded around a 40 NTM pe, so it’s quite cheap relative to it’s historical valuation.

For a business growing 15–20% annually with 30% EBIT margins, that looks very reasonable.

Why So Cheap?

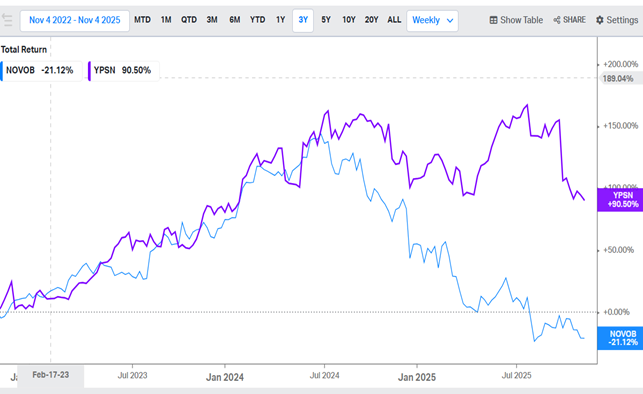

The problem is that the market still views Ypsomed as a company dependent on Novo Nordisk. As mentioned earlier, the stock fell sharply after the announcement of the oral Wegovy trial results. Investors seem to believe the threat from oral pills is immediate — which, as we’ve discussed, is far from the case.

You can also clearly see that Ypsomed’s share price has tracked Novo Nordisk’s decline since July 2024, when Novo’s stock started to fall. I expect Ypsomed could rebound strongly once the market realizes that this company is not dependent on Novo Nordisk or GLP-1 drugs.

Ypsomed share price declines in tandem with Novo Nordisk.

Risks

The risks to the thesus I would say are:

Production-line delays: Dependence on external suppliers of assembly lines could temporarily slow capacity expansion.

Margin pressure during scale-up: High CapEx and new-plant ramp-up may weigh on margins in the near term.

Cash-flow timing: Heavy investment means free cash flow likely won’t turn positive until FY 2028/29 (Source: Ypsomed)) — a risk if credit markets tighten or a downturn hits.

Threat of oral pills, for the moment not likely.

Dependence on pharma clients’ drug success and launch timing. If a lot of drugs currently in clinical testing doesn’t get approved, Ypsomed may earn less revenue from commercial sales later on.

Key Takeaway

Ypsomed is at the start of a multi-year growth runway, fueled by the global rise of biologic medicines. With 30% margins, mid-teens to 20% growth, and a NTM P/E of ~24, the risk-reward looks attractive.

As more pharma companies outsource injector production and the market realizes Ypsomed’s limited dependence on Novo Nordisk, the stock could rerate sharply higher.