The Trade Desk: structural or temporary slowdown?

Intro

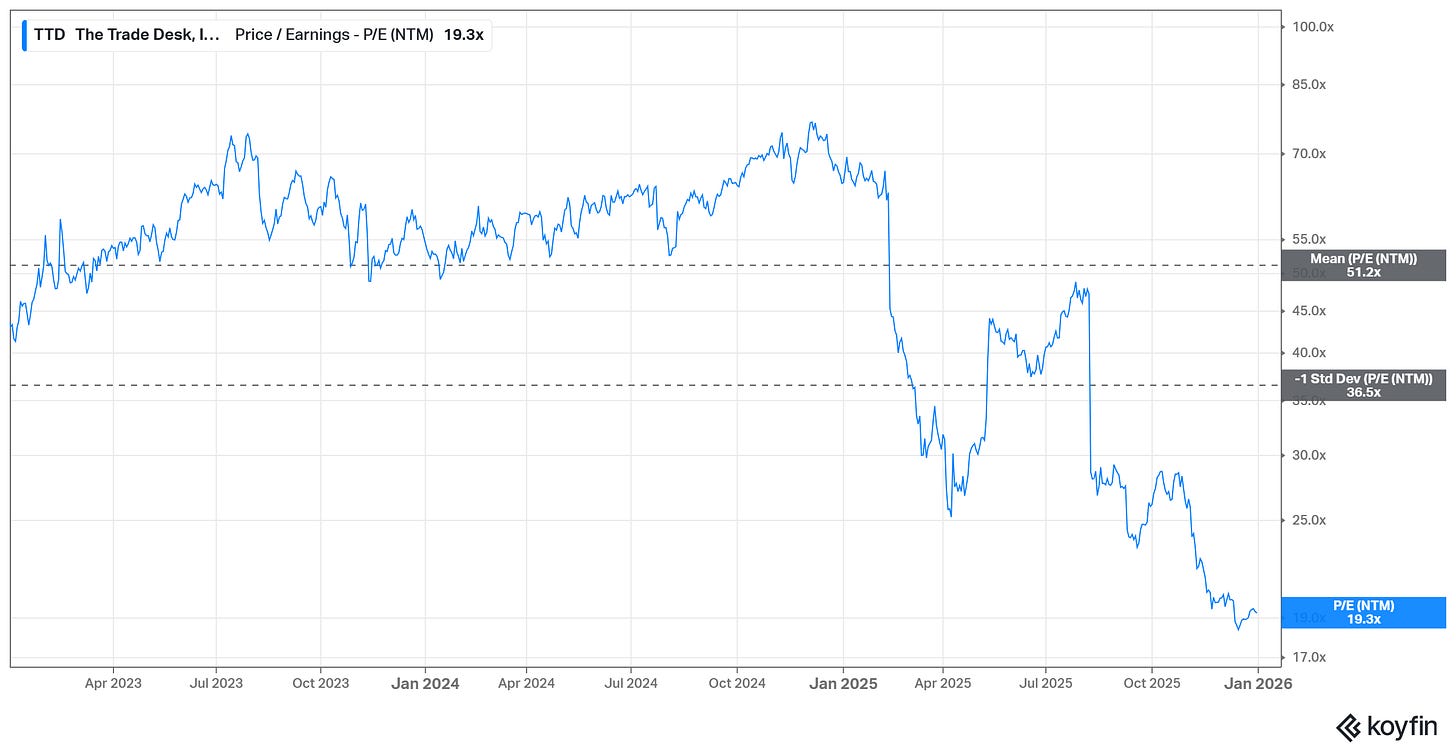

The Trade Desk (TTD) is a company I hold in my portfolio, and its share price has been obliterated recently. The NTM (next twelve months) P/E ratio is currently 19.4, which is the cheapest NTM P/E multiple at which this stock has ever traded.

Is TTD in a Netflix-style freefall, similar to when Netflix fell after reporting a slowdown in subscriber growth in April 2022? The market clearly interpreted that slowdown as structural, sending Netflix shares down roughly 30% in a single day.

Are TTD’s problems structural, or is the market panicking? I am personally trying to determine whether to add to, hold, or sell this stock in my own portfolio.

For readers unfamiliar with (TTD): the company provides a platform that enables buyers—primarily advertising agencies—to purchase ads on the “open internet.” A brand can set a budget and advertise across multiple channels, such as connected TV (CTV), audio (podcasts), display ads, in-app placements, or retail media (e.g., Walmart Connect or Kroger Precision Marketing). The goal of the platform is to allocate a client’s advertising budget as efficiently as possible, directing spend to where it is most effective.

What happened to growth?

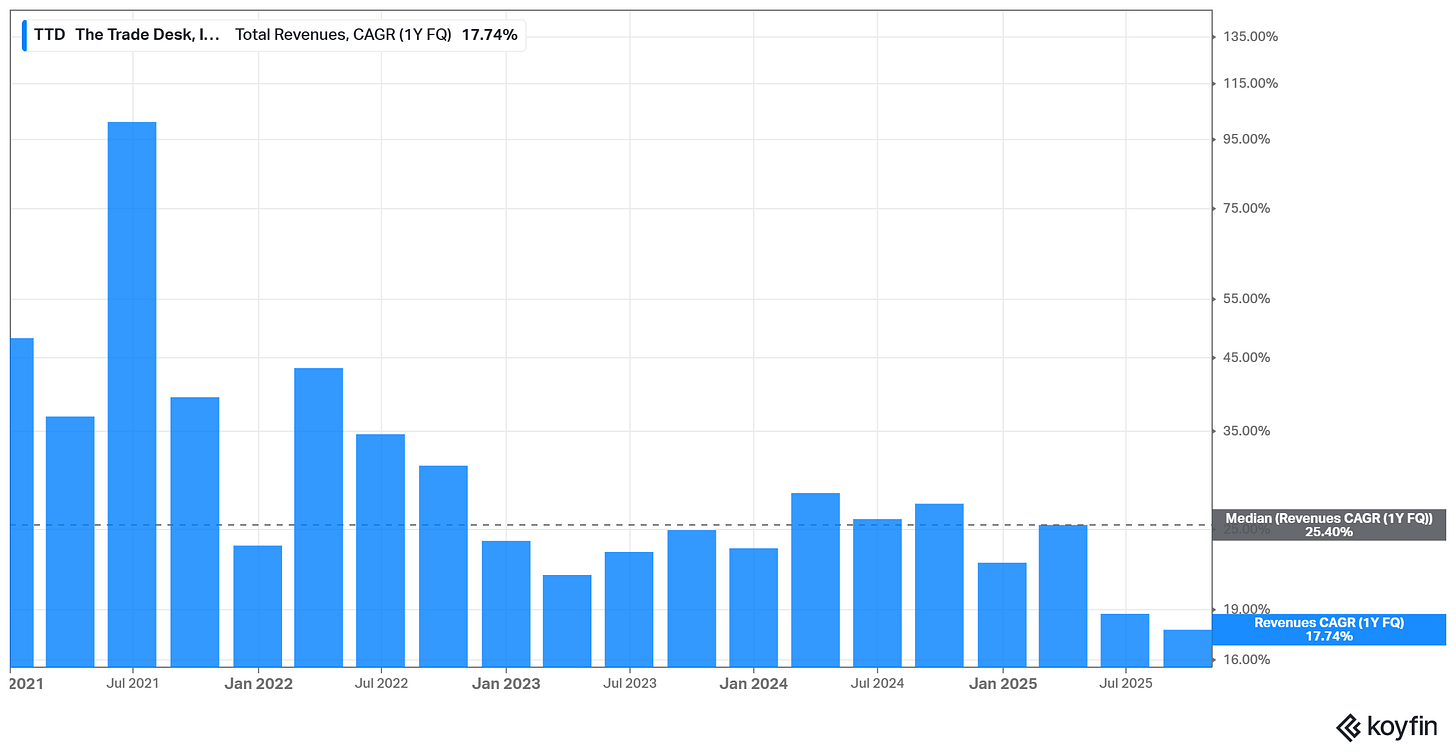

The core issue is that quarterly revenue growth has slowed, bottoming at 17.74% in the third quarter of 2025. Over the past five years, the median quarterly growth rate has been 25%, meaning the company is now growing materially slower than it has historically. This slowdown is the primary reason the stock has tanked: the market believes growth has stalled.

The Trade desk quarterly revenue growth rate (yoy)

Let’s take a closer look. TTD relies on advertiser spending; the business is cyclical and therefore susceptible to shocks in advertising budgets.

This is what Jeff Green said during the Q2 2025 earnings call:

“As I mentioned before, Q4 was relatively stable, though signs of volatility were building beneath the surface ahead of a contentious election cycle. That pressure intensified in Q1 with growing concern among clients.”

He then addressed the Q2 quarter:

“From a macro standpoint, some of the world’s largest brands are absolutely facing pressure and a degree of uncertainty. Some have to respond more than others to tariffs. Many are managing inflation worries and the related pricing that comes with that.”

In Q3, he echoed these conclusions. His view is that the lower growth rate is largely attributable to a more uncertain macroeconomic backdrop, driven by tariffs and broader macro volatility.

That explanation is plausible, as advertising spending can be highly volatile. In Q2 2020, TTD’s quarterly growth rate dropped sharply to -12.86% due to the pandemic shock. The beginning of 2025 also represented a relatively large shock, given the tariff environment and fears of a potential recession or economic slowdown. It is therefore plausible that advertisers reduced spending.

Furthermore, TTD has noted that excluding political spending, quarterly growth would have been approximately 22%. This adjustment matters because growth in Q3 2024 was exceptionally high (27.3%) due to political advertising. Excluding that effect, Q3 year-over-year revenue growth would have been closer to 22%. In that scenario, investors likely would not be panicking.

Is programmatic still taking share of overall advertising?

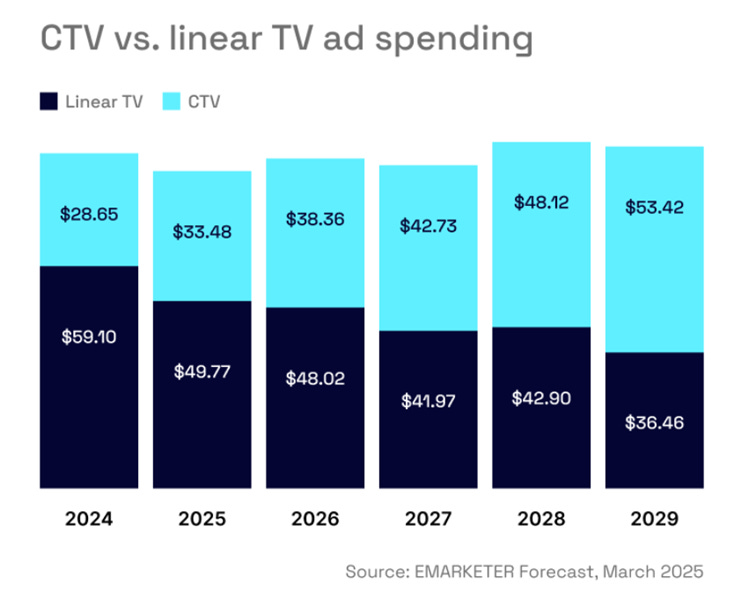

As mentioned, TTD is essentially a platform where brands buy advertisements on the open internet. The largest segment (about 50% of the business) is CTV (streaming television) advertising. If you look at the chart below, total U.S. CTV ad spend is still only 32% of total TV ad spend. This suggests the market is far from maturing. Projections indicate that CTV ad spend will roughly double by 2029 compared to 2024.

While CTV ad spend is still only 32% of total spend, CTV viewership already accounts for between 40–60% of total viewership. Conclusion: a majority of ad spend still needs to migrate toward CTV. Given the growth runway left for CTV, there is every reason to believe that TTD can maintain its CTV growth trajectory based on the total addressable market (TAM) opportunity. This does not point to stalling revenue growth for TTD.

Growth acceleration

In fact, one could argue that growth will accelerate in 2026. If you read the Q2 earnings call carefully, Jeff Green states:

“We are signing more multiyear JBPs, or joint business plans, than ever before with leading agencies and brands. In fact, the number of live JBPs is at an all-time high, and we continue to see spend under JBPs significantly outpace the rest of our business. What’s even more encouraging is the strength of our JBP pipeline, with nearly 100 JBPs in progress, many of them in the late stages of development.”

And:

“We see clearly what is on the horizon for our space, and we’re convinced we’re the best-positioned company in adtech to accelerate our growth in 2026.”

Talking explicitly about accelerating growth is not something management would do unless they were confident about future growth.

Audio

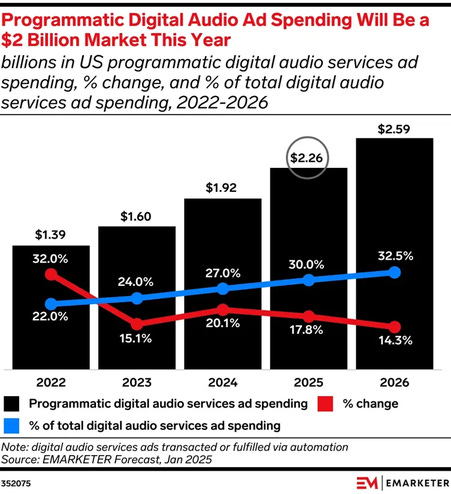

I believe another major growth avenue in the coming years is audio—not traditional radio, but digital audio such as Spotify, Pandora, iHeart, TuneIn, SoundCloud, SiriusXM, and similar platforms. TTD has integrations with all of them. This market is rapidly shifting toward programmatic advertising. As recently as April 2025, Spotify introduced its Spotify Ad Exchange, enabling advertisers to bid programmatically on Spotify’s audio inventory.

Demand for podcast advertising, in particular, is enormous. Jeff Green stated in the Q3 earnings call:

“Audio has become one of the fastest-growing channels as consumers spend an average of three hours a day listening to their favorite music and podcasts. Over time, I expect CTV and audio will grow as a percentage of mix, fueled by the premium authenticated nature of these channels.”

According to Digiday, programmatic buys on Spotify alone grew 58% year over year. Currently, most podcast ads are pre-recorded and therefore not tailored to the individual listener. Programmatic audio advertising enables ads to be served dynamically to specific listeners, significantly increasing value for advertisers compared to pre-recorded ads.

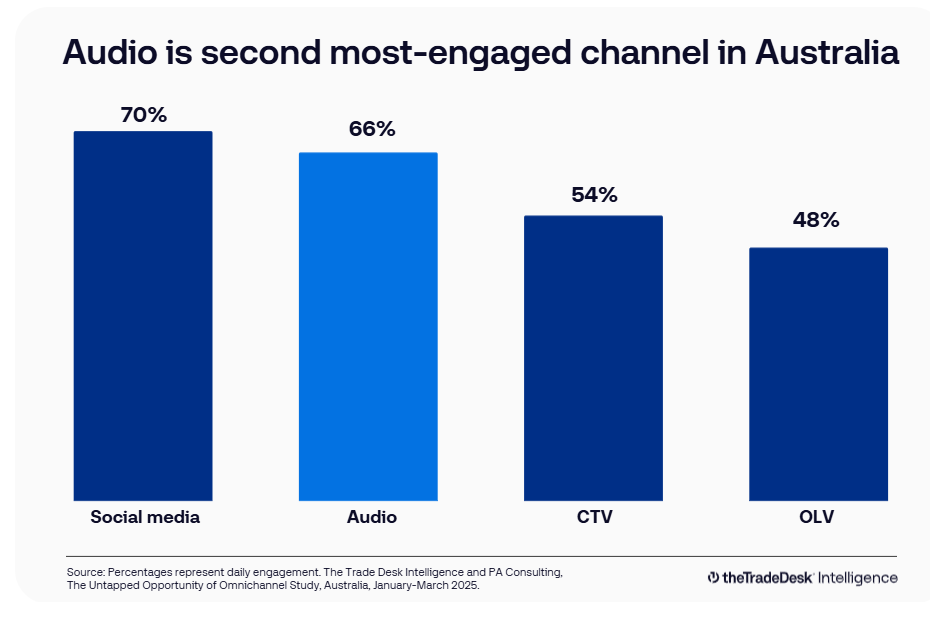

Considering how much time people spend listening to audio—while driving, exercising, or taking a walk—I agree with Green that audio is likely to become the second-largest channel after CTV.

According to eMarketer, programmatic audio spend is expected to reach $2.6 billion in 2026, representing a 17% CAGR since 2022.

In my opinion, audio has a big future, considering the engagement audio has during the day. One research in Australia for example finds that digital audio has a higher engagement then CTV:

While audio currently represents only about 5% of TTD’s business, the key takeaway is that audio is likely to become a meaningful growth driver—much like CTV has been in recent years—further cementing TTD’s long-term growth runway.

Amazon

A concern I often see among analysts and fellow writers is the perceived threat from Amazon’s own DSP (demand-side platform) and, to a lesser extent, Google’s DSP. Amazon operates its own DSP, allowing advertisers to buy ads directly through its platform. The issue is that Amazon and Google face a conflict of interest: they own both the buying platform and the inventory.

As a result, they have an incentive to direct ad spend toward their own properties. For Amazon, this includes Amazon Prime, Fire TV, and Amazon.com.

TTD, by contrast, does not own inventory and routes ad spend to the placements that deliver the highest value for the advertiser. Generally speaking, the ad auction process is less transparent within Amazon DSP compared to TTD. Since advertisers tend to favor transparent bidding processes, this creates a structural disadvantage for Amazon DSP.

One area where TTD’s neutrality clearly stands out is reporting. TTD provides log-level data for ad campaigns, offering detailed insight into when an ad was served, on which website or app, at what price, and to which ID.

Amazon, on the other hand, primarily provides aggregated reports. While some granularity exists, it is largely restricted to the Amazon ecosystem. In short, Amazon tells you how your ads performed; The Trade Desk lets you verify it yourself.

Another important point is that TTD shows how your bid compares to the clearing price—the price actually paid for an impression. This allows advertisers to assess whether they are overpaying or underpaying, which is valuable input for future bidding decisions. Amazon typically reports average CPMs, but not impression-level pricing. As a result, with Amazon DSP, advertisers cannot know with certainty whether an ad placement on an Amazon property represented better value than an alternative on the open internet.

Where Amazon Does Compete

Amazon is strongest when the shopper journey happens on Amazon. If a user browses on Amazon, searches for a product, or adds something to their cart, that information is very valuable to an advertiser. If that same user then watches content on Prime Video and later purchases something on Amazon.com, advertisers can clearly see that the ad worked. That is gold for marketers.

However, when a user does not have a meaningful “Amazon footprint,” the value of Amazon DSP declines.

I believe advertisers will therefore continue to use both platforms together: Amazon DSP for high-quality purchase data within the Amazon ecosystem, and The Trade Desk for reaching users across the open internet.

While Amazon is actively working to expand its access to the open internet, TTD still offers far greater breadth. It connects to tens of thousands of publishers, something Amazon cannot match. For example, TTD has partnerships with major U.S. retail media networks such as Kroger, Walmart, Target, and Instacart, as well as international retailers like Tesco in Europe. Through TTD, advertisers can run ads across multiple retail networks without having to connect to each marketplace individually.

Naturally, advertisers cannot access Walmart Connect via Amazon DSP—another consequence of Amazon’s inherent conflict of interest.

Why TTD’s Breadth Matters

TTD’s broad reach in comparison to Amazon delivers several important advantages:

Omnichannel synergy:

Campaigns that run across multiple channels tend to be more efficient than those limited to a narrow set of channels. Advertisers have a higher probability of reaching users throughout the day by combining CTV, audio, display, mobile, and other channels.Better price discovery:

TTD participates in millions of ad impressions per second, allowing it to identify cheaper ads. In practice, this means routing ad budgets toward the highest-value opportunities.First-price auction optimization:

In recent years, the ad tech industry has largely shifted to first-price auctions, where bidder A bids $10, bidder B bids $8, and bidder A pays $10. This differs from second-price auctions, where bidder A would have paid $8.01. In a first-price environment, accurately estimating the optimal bid is critical. TTD’s access to broad open-internet data allows its AI to predict clearing prices more effectively because it has broader acces to “liquidity” in the ad market. Amazon, with more limited access to the open internet, does not see the entire “order book,” to remain speaking in stock market terminology.

In short, TTD benefits from two major structural advantages: its neutrality and its breadth.

Competitive Perspective

It is also worth noting that Amazon DSP and Google’s DV360 have been around for a long time. DV360 has effectively existed for roughly 14–15 years, while the DV360 brand itself has been in place for about 7 years. Amazon DSP has been around for approximately 12–13 years, with the Amazon DSP brand existing for around 6–7 years. During this entire period, TTD has delivered exceptional growth.

My view is that Amazon is a competitive threat, and its efforts to expand access to third-party publishers bring it closer to TTD’s territory. However, in practice, it is not a full substitute. As an advertiser, you want breadth and liquidity in order to route ad budgets as efficiently as possible—and that remains TTD’s core strength.

Valuation and Conclusion

I believe the recent slowdown in growth appears far more likely to be the result of a temporary shock—driven by tariffs, macro uncertainty, and advertiser caution—than a structural change in the business. Advertising spend has always been cyclical, and nothing suggests that The Trade Desk’s long-term opportunity has materially deteriorated.

The addressable market remains enormous. CTV advertising is still significantly underpenetrated relative to viewership, programmatic advertising continues to take share, and audio is emerging as an additional growth runway. On top of that, management has indicated that Joint Business Plans (JBPs) are at all-time highs. It is difficult to reconcile that level of long-term advertiser commitment with the idea that TTD’s growth story is broken.

Concerns around competition from Amazon DSP and Google DV360 also appear overstated. Both platforms have existed for many years, during which The Trade Desk delivered exceptional growth. Their products are fundamentally different. Amazon DSP is extremely powerful for advertisers targeting users within the Amazon ecosystem, but Amazon does not own the broader retail landscape. If I were an advertiser, I would absolutely use Amazon DSP to reach Amazon shoppers—but I would still need The Trade Desk to reach the open internet at scale.

From a valuation perspective, expectations appear pessimistic. Analysts are projecting a non-GAAP EPS CAGR of roughly 16% for 2025–2028, materially lower than the 22% CAGR achieved from 2021–2024. In other words, the market is already pricing in a significant slowdown. If analysts are correct and 2028 non-GAAP EPS reaches $2.77, applying today’s depressed NTM P/E of approximately 19.4 would imply a stock price of roughly $54 by the end of 2027. From today’s price of $38.12, that represents a return of approximately 42%.

If, however, TTD is able to achieve an EPS CAGR closer to 20% over the next three years—below its historical growth rate but above current consensus—EPS would reach roughly $3.08 by 2028, starting from a 2025 EPS of $1.78. Applying a NTM P/E of 37, which is one standard deviation below the three-year average P/E of 51.2, would imply an end-2027 stock price of approximately $113, representing a 197% return from today’s levels.

TTD three year NTM PE

That scenario does not require a return to peak growth or peak valuation—only a partial normalization.

With pessimistic growth assumptions and a compressed valuation, downside appears limited, while upside remains substantial if growth only modestly re-accelerates.

Risks

The two main risks for the thesis are most probably:

• Prolonged macro weakness in advertising spend. If we assume that the decline in growth rates is not structural, but temporary due to macro weakness, then continued macro weakness could still hurt TTD’s future growth rates. TTD revenues have shown that they are sensitive to macro shocks, such as in Q2 of 2020, when growth turned negative at –13%.

• Walled gardens increasingly connecting advertisers with third-party ad inventory. This would occur if Amazon or Google increasingly offered ad inventory on properties other than their own. In that case, TTD’s moat—its reach—would weaken.

Still, given the risks, I think the risk–reward setup is fairly attractive. I rate the stock as a Strong Buy.

Disclosure: I am long The Trade Desk at the time of writing.

This article represents my own analysis and reflects how I think about long-term business fundamentals and risk–reward. It is not a recommendation to buy or sell securities.

If you enjoyed this deep dive, consider subscribing or sharing — and feel free to comment with questions or counterarguments.